The Carbon Tax Rebate Explained: How It Works and How Much You'll Get

Understanding Your Climate Action Incentive: The Carbon Tax Rebate in Canada

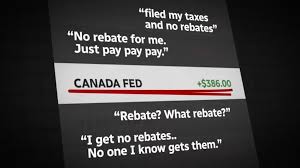

Canada has implemented a carbon pricing system as a key part of its strategy to combat climate change. While the "carbon tax" might sound like an additional burden, for many Canadians, it comes with a significant offset: the Climate Action Incentive (CAI) payment, often referred to as the carbon tax rebate. This tax-free amount is designed to return the majority of the carbon pricing revenue directly to individuals and families. Understanding how it works and how much you'll get is crucial for managing your finances in Canada.

What is the Carbon Tax?

The carbon tax is a federal levy applied to fossil fuels (like gasoline, natural gas, and propane) in provinces that do not have their own carbon pricing system that meets federal standards. The goal is to make polluting more expensive, encouraging individuals and businesses to reduce their carbon footprint.

What is the Climate Action Incentive (CAI) Payment?

The CAI payment is a tax-free amount paid to individuals and families to help offset the cost of the federal carbon pollution pricing. It's designed to ensure that most households receive more money back than they pay in carbon tax.

Key Features:

- Tax-Free: The payment is not considered taxable income.

- Quarterly Payments: Received four times a year (typically in April, July, October, and January).

- Automatic: You don't need to apply for it; it's automatically assessed when you file your income tax return.

Who is Eligible for the CAI Payment?

You are generally eligible for the CAI payment if you are a resident of Canada for income tax purposes and live in a province where the federal carbon tax applies (currently Alberta, Saskatchewan, Manitoba, Ontario, New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador).

Important: You must file an income tax return every year to be assessed for eligibility and to receive the payment, even if you have no income to report.

How is the CAI Payment Calculated?

The amount you receive depends on your province of residence, your family size, and whether you live in a rural area. The payment includes a basic amount for each adult and child in a household, plus a supplement for residents of small and rural communities.

Example (Illustrative, amounts change annually):

For a family of four (two adults, two children) in Ontario, the annual payment might be around $1,000 - $1,200, paid in quarterly installments. Residents of rural areas often receive an additional 10% supplement.

| Province | Base Amount (Individual) | Spouse/Common-Law Partner | Per Child | Rural Supplement |

|---|---|---|---|---|

| Alberta | $225 | $112.50 | $56.25 | 10% |

| Ontario | $140 | $70 | $35 | 10% |

| Manitoba | $150 | $75 | $37.50 | 10% |

(Note: These amounts are illustrative and subject to change by the CRA annually. Always refer to the official CRA website for the most current figures.)

How to Receive Your CAI Payment

The process is simple:

- File Your Income Tax Return: This is the only action required. The CRA uses the information from your T1 income tax and benefit return to determine your eligibility.

- Ensure Direct Deposit: Set up direct deposit with the CRA to receive your payments quickly and securely.

If you are eligible, the payments will be automatically sent to you. You will receive a notice from the CRA explaining your eligibility and the amount you will receive.

Conclusion: A Benefit Designed to Help

The carbon tax rebate, or Climate Action Incentive payment, is a significant benefit designed to help Canadian households offset the costs of carbon pricing. By simply filing your income tax return each year, you ensure that you receive this tax-free money, which can provide valuable financial relief. Don't miss out on this important government subsidy; it's part of Canada's commitment to both environmental action and supporting its citizens.

Related content